Having the right NZ KiwiSaver provider makes all the difference to your future returns

KiwiSaver is a voluntary, work-based savings initiative to help you with your long-term savings for retirement and get you into your first home quicker. It’s designed to be hassle-free so it’s easy to maintain a regular savings pattern. We love helping our clients maximise their retirement with KiwiSaver. Here’s why it offers you benefits no other investment can.

When you join a KiwiSaver scheme you will receive:

- A 3% contribution from your employer.

- Government Contributions of up to $521.43 every year. For every $1 you put into your KiwiSaver scheme from 1st July until the 30th June, the Government will put in 50 cents up to a maximum of $521.43 per year.

- Ability to withdraw for your first home if you’ve never owned a home, and you’ve been a KiwiSaver member (or a member of a complying superannuation fund) for a combined total of at least three years. (conditions apply)

- Up to $10,000 Home Start Grant from the Government towards your first home. (conditions apply)

- Your money is held in trust. Whether you are with a big Aussie bank or a New Zealand owned KiwiSaver Specialist, the law requires your investment to be held be a licensed supervisor and not the scheme provider.

- Over 65’s can now join without a locked in period.

How We can Assist You with KiwiSaver

By having your KiwiSaver plan setup correctly you could potentially save hundreds of thousands more towards your retirement. Lifestyle Cover has teamed up with the KiwiSaver specialists at Generate and Booster to provide you with Class Advice and general information on KiwiSaver*.

Why use our KiwiSaver Providers?

Generate and Booster are NZ owned KiwiSaver Specialists and their services are rated very highly. Generate has been looking after clients since 2012 and Booster has been supporting its customer for over 20 years. They are both default providers and use ESG filters when choosing the companies they invest in, these filters include environment, social and governance factors adhering to their own responsible investment policies.

Common pitfalls we find with KiwiSaver:

- Tax rate (PIR) incorrect. Unsure if you are paying too much or too little tax on your investment? If you are paying too much tax, then you are not eligible for a refund on your overpaid amount, think of the lost savings from your retirement fund!

- Wrong fund choice. Are you feeling disappointed that your KiwiSaver balance isn’t growing as fast as you thought it would? There is still a lot of people sitting in default funds or they have not taken the time to review their KiwiSaver since their situation changed. This can potentially mean they miss out on hundreds of thousands of dollars towards their retirement. Make sure you are not one of them.

- Government Contributions left unclaimed. Are you unsure if you have been receiving the free money from the Government each year? It doesn’t matter if you are currently self employed or not working, providing you are a permanent resident or a NZ Citizen between the ages of 18 and 64 years old you will be entitled to $521 each year from the Government. So make sure you are claiming your full entitlement.

- Poor Provider choice. Sometimes we hear that a client has decided to go with a KiwiSaver provider purely for convenience. But what’s more important is that you are happy with their investment philosophy and you feel they are giving you the very best service and advice.

So how much do you know about your KiwiSaver?

When choosing your own Fund, it’s vital to think about how much time you have before you need your savings and how comfortable you are with the value of your savings going up and down in the short term. Generally, the longer you have until retirement the more growth assets you should hold to maximise the potential of your KiwiSaver account balance. But, if you are planning to buy your first home or nearing retirement in the next three years you might be best to consider the Conservative Fund. You can also choose to split your savings into more than one Fund to give you as much flexibility as possible over your investment. Try the quiz below to see how much you know.

Why is choosing the right fund so important?

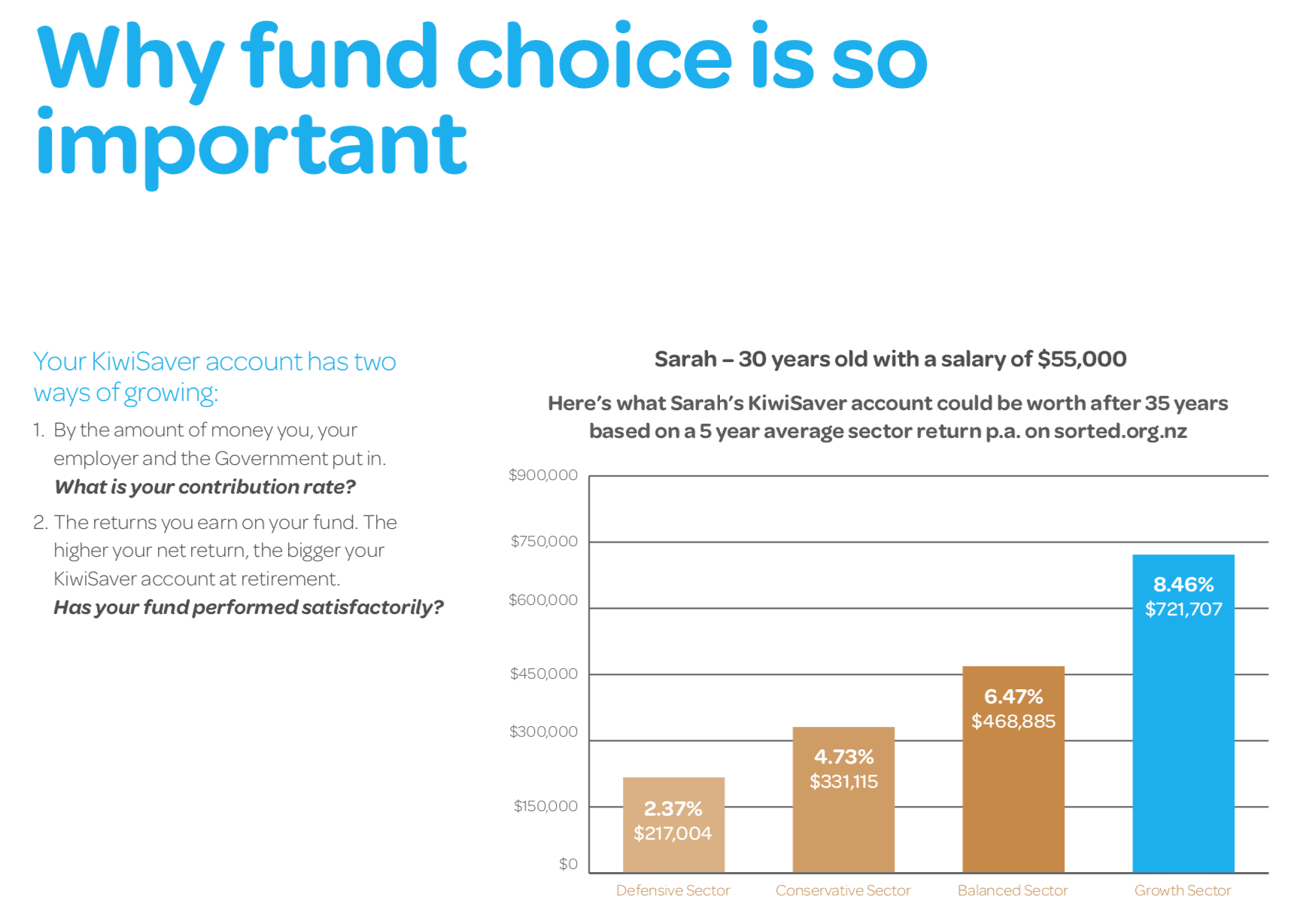

Remember how we said this could mean hundreds of thousands of dollars difference for you at Retirement. Here is a great example of why you need to know which fund you are in!

The below graph shows that if this client is contributing into a default fund until retirement they would have received an estimated $217,004 with an average return of 2.37%, whereas if they invested in the Growth Fund their estimated retirement savings would be $721,707 with an average return of 8.46%! The only difference here is fund choice, the client has made the same contributions in both the examples.

Want to know how much you could say for your retirement?

Generate have provided us with a great tool for you to utilise to Calculate your own expected Retirement Savings. You can use this calculator to see what a difference increasing your contributions can make as well as changing your fund choice.

Want to sign up today?

Or for more information on the benefits of KiwiSaver, contact the Lifestyle Cover Team – our Auckland-based Financial Advisers are ready to assist you with your KiwiSaver and other insurance policies including life insurance, private medical cover, and house, contents, and car insurance.